Payment Method

Pay With Credit/Debit Card

Credit card payment method

The available credit card options are listed above. The credit card companies listed above are the most commonly used credit cards on this website. Do not worry if your credit card company is not listed, we encourage you to go ahead and make the purchase.

Please note that does not collect your credit/debit card number or personal information when you make a payment. For questions regarding your transactions on our site, please consult your card-issuing bank for information.

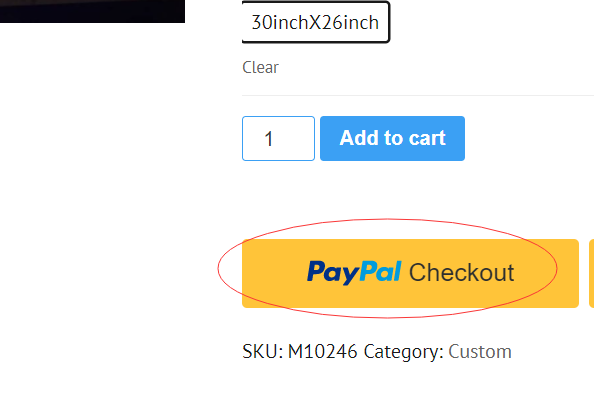

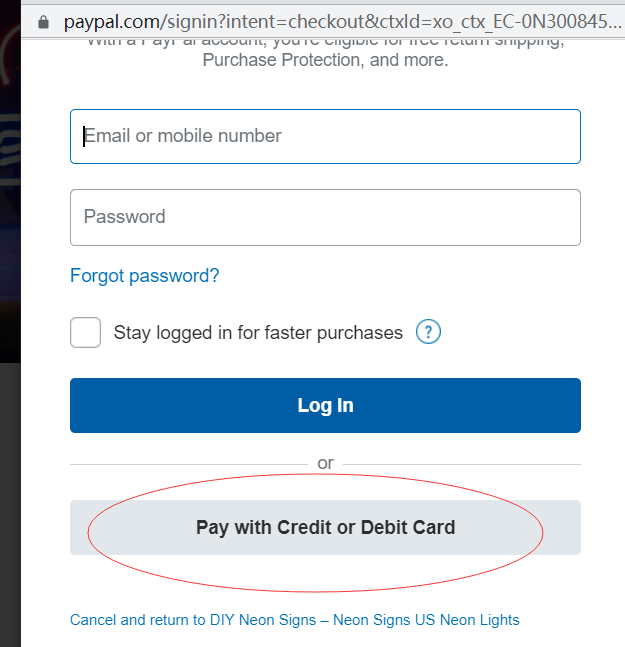

Pay With Paypal

When you place an order with Paypal you will be redirected to the PayPal payment page, where you can confirm your payment by logging in with your PayPal username and password.

You may still check out even without a PayPal account. To do so, please click on “Pay with Debit/Credit Card” and you’ll be redirected to a secure page where you can enter your credit card information or complete your payment safely via PayPal.

Get it now and pay for it over 4 equal payment installments, every two weeks.

There’s zero interest, zero fees if you pay on time, and you can enjoy your purchase now!

For more, just click here .

NOTES:

Please make sure that you enter the coupon code exactly as you received it, with no space before, within, or after it. To avoid errors, we recommend you to copy/paste the promotional code you received.

Coupons cannot be combined. You can only use one coupon code per order.

Coupons are subject to offer terms. This does exclude some items on our website which are not eligible for coupon discounts.

You can pay up to 70% of your purchase with bonus points at checkout. Remember that 100 points = $1.

Sales & Use Tax

1.What is Sales & Use Tax?

Sales & Use Tax (“Sales Tax”) will be charged by applicable states of the US to customers who purchase from us. We are required by law to collect Sales Tax in those states. You will see the Sales Tax applied to your order once you confirm your shipping details and proceed to checkout.

2.How is Sales & Use Tax calculated?

Sales Tax is calculated on the total merchandise value net of any discount. Total taxes may also include taxes charged on the delivery and shipping fees (if taxable in your state).

Sales Tax charged on your order will be displayed at the checkout stage.

3.Will Sales & Use Tax be refundable?

In case of returns and/or refunds, the appropriate Sales Tax will also be refunded to your wallet of account or to the original method of payment.